Bitcoin Price Outlook After Brazil’s Largest Private Bank Itaú Backs Crypto Investment

Published: Dec. 14, 2025 – 16:30

Updated: Dec. 14, 2025 – 16:35

Brazil’s largest private bank, Itaú, has added fresh momentum to the global cryptocurrency conversation after its asset management arm advised investors to allocate a portion of their portfolios to Bitcoin.

According to a report released earlier this week, Itaú Asset Management recommended that investors consider allocating between 1% and 3% of their portfolios to Bitcoin (BTC) in 2026, citing diversification benefits and long-term growth potential — despite ongoing market volatility.

Itaú Analyst: Bitcoin Offers Uncorrelated Portfolio Protection

Renato Eid, an analyst at Itaú, said Bitcoin operates on fundamentally different principles compared to traditional asset classes such as equities, fixed income, and domestic investments.

While price volatility remains a defining feature of Bitcoin, Itaú believes the digital asset can act as a portfolio diversifier, offering potential upside during periods when conventional investments underperform.

The recommendation places Itaú alongside major U.S. financial institutions such as Morgan Stanley and Bank of America, which have also encouraged measured exposure to cryptocurrencies, typically suggesting allocations ranging from 1% to 4%.

Currency Strength Adds Pressure for Brazilian Investors

The move comes amid heightened volatility in Brazil’s domestic markets. The Brazilian real has strengthened by more than 15% against the U.S. dollar this year, amplifying losses for local investors holding dollar-denominated assets like Bitcoin.

Internal research from Itaú highlighted a limited correlation between Brazil’s locally traded Bitcoin ETF (BITI11) and other major asset classes, reinforcing the argument for Bitcoin’s diversification role within broader portfolios.

Bitcoin Price Analysis: Buyers Defend Key Support Near $90,000

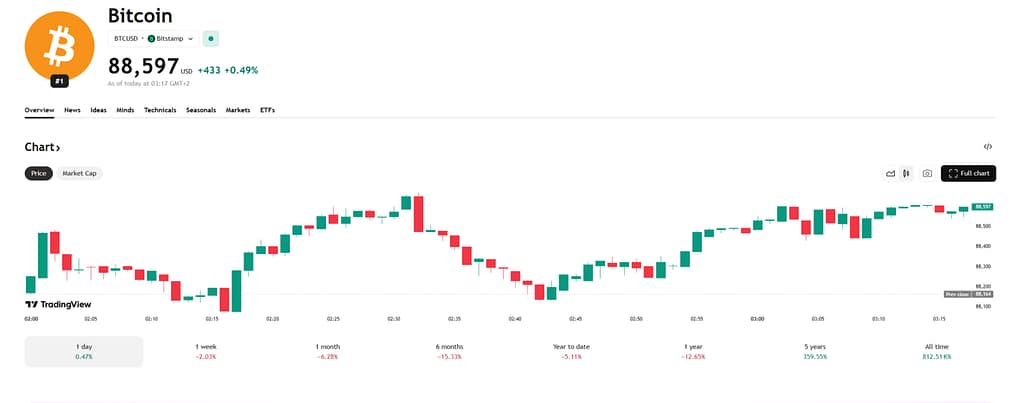

From a technical perspective, Bitcoin is currently trading slightly higher at around $90,467, up approximately 0.22% on the day.

Daily charts show Bitcoin continuing to move within a descending channel following its October peak. Recent candlestick formations display long lower wicks, a classic technical signal indicating selling pressure met by renewed buying interest.

Bitcoin is now testing the lower boundary of this descending channel near $90,000, while a major support level remains around $80,638.

On the upside, key resistance stands near $102,152, followed by a stronger barrier around $116,453.

The Relative Strength Index (RSI) is currently at 44.61, hovering near neutral territory and suggesting room for further consolidation or downside movement before entering oversold conditions.

What Comes Next for Bitcoin?

If Bitcoin were to pull back toward the $80,000 support zone, analysts believe a strong rebound could follow, potentially pushing prices back toward $102,000 — and even $116,000 if bullish momentum accelerates.

However, failure to hold current levels could lead to a faster continuation of the correction. A decisive bounce accompanied by rising trading volumes would be needed to confirm a trend reversal.

⚠️ Important Disclaimer

This article is for informational and analytical purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research or consult a licensed financial professional before making investment decisions.