Venezuela’s Crisis Escalation: A One-Month Timeline From Oil Tanker Seizures to Maduro’s Capture

Published: January 3, 2026

By: USA News Today – Analysis Desk

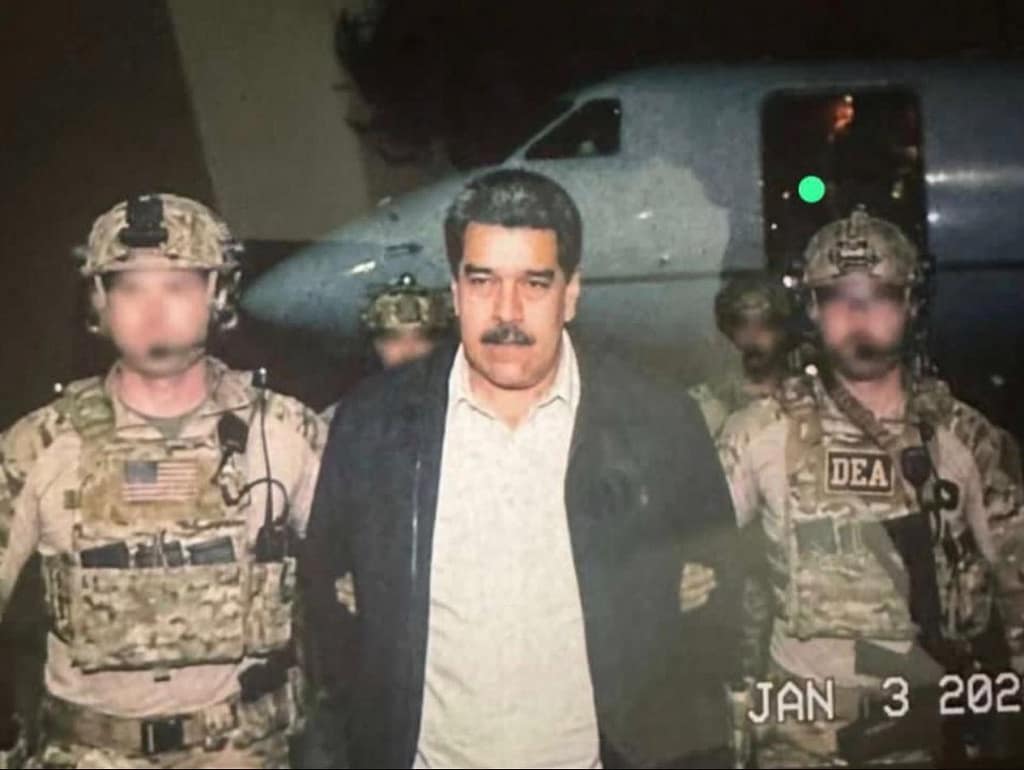

Venezuela’s political crisis took a dramatic turn on January 3, 2026, when U.S. President Donald Trump publicly claimed that U.S. forces captured Venezuelan President Nicolás Maduro and First Lady Cilia Flores during a pre-dawn military operation in and around Caracas. Reuters+2AP News+2

That moment did not arrive out of nowhere. Over the previous month, Washington steadily tightened pressure on Caracas—especially around Venezuela’s oil lifeline—with a sequence of actions that included tanker seizures, an announced “blockade” of sanctioned shipping, and reports of Venezuela scrambling to store crude offshore as exports slowed. Reuters+2Reuters+2

Below is a clear, month-long timeline of how the situation escalated—what we know, what remains disputed, and why the oil dimension matters so much.

Why Oil Is the Center of Gravity

Oil is not just another sector in Venezuela. It is the country’s fiscal bloodstream: government revenue, foreign currency, fuel supply, and imports flow through it. When oil exports are disrupted, everything—from public services to inflation—can spiral.

That is why recent U.S. measures targeting tanker movements and exports were widely interpreted as pressure aimed at Maduro’s ability to govern. Reuters+1

The Last Month: Key Events That Set the Stage

Dec. 10, 2025 — U.S. Seizes a Tanker Off Venezuela

Reuters reported that the U.S. seized a sanctioned oil tanker off Venezuela’s coast, a move that immediately raised tensions and signaled a new willingness to physically interdict shipments tied to Caracas. Reuters

That single action mattered for two reasons:

- It warned shippers that cargoes could be taken, not just sanctioned.

- It increased the risk premium for any vessel approaching Venezuelan waters.

Mid-December — Export Shock Ripples Toward China

As the tanker seizure reverberated through markets, Reuters described how traders and analysts expected near-term cushioning in China due to stored supply and weaker demand—but still noted that Venezuelan exports fell sharply after the seizure and associated enforcement measures. Reuters

Even when markets absorb disruption, the political message remains: Venezuela’s exports were now vulnerable to direct interference.

Dec. 16–18, 2025 — Trump Announces a “Blockade” of Sanctioned Tankers

Reuters then reported that Trump ordered a “blockade” of sanctioned oil tankers entering or leaving Venezuela—effectively escalating from isolated interdictions to a broader posture aimed at restricting flows. Reuters

Reuters also reported that exports fell sharply and that the disruption was compounded by a cyberattack that affected PDVSA’s administrative systems around that period. Reuters

Why this mattered:

A blockade—formal or informal—changes behavior. Tankers and insurers often avoid the risk entirely, which can paralyze exports even without constant physical seizures.

Dec. 21–22, 2025 — U.S. Pursues/Intercepts Additional Vessels

Reuters reported U.S. action involving another vessel near Venezuela as enforcement continued, reinforcing the message that the blockade posture was not symbolic. Reuters

Dec. 23, 2025 — Venezuela Turns to Floating Storage

With onshore tanks filling, Reuters reported that Venezuela increasingly relied on floating storage (using tankers as storage units offshore) to keep the system from choking completely. Reuters

Why this is a red flag:

Floating storage is often a crisis workaround. It can keep production moving briefly—but it’s expensive, inefficient, and signals the export system is clogged.

Dec. 30, 2025 — Tankers Still Move Toward Venezuela Despite the Blockade

Reuters reported that, despite the U.S. blockade posture, some tankers still made their way to Venezuela and others were navigating toward the country, suggesting PDVSA was trying to expand storage and keep selling crude even as exports were reduced to a minimum. Reuters

This shows a key pattern in the month:

- Washington increased pressure to restrict exports.

- Caracas tried to adapt operationally rather than concede politically.

Dec. 31, 2025 — Storage Pressure Intensifies

Reuters reported that residual fuel was filling Venezuela’s storage tanks as exports remained almost paralyzed, forcing PDVSA into “extreme solutions” to avoid shutdowns at refining units. Reuters

Operationally, this is what “economic pressure” looks like in real time: not just lost revenue, but bottlenecks that can force production cuts and risk industrial incidents.

Jan. 3, 2026 — The Military Operation and Maduro’s Capture Claim

What Trump Said

On January 3, Trump said U.S. forces captured Maduro and Flores during a major strike operation. Multiple outlets reported the claim and the broad outline: strikes in and around Caracas, followed by a U.S. extraction. AP News+2The Washington Post+2

Reuters: “Operation Absolute Resolve”

Reuters reported details of a months-long preparation effort and described a U.S. special forces raid supported by intelligence operations, airstrikes to suppress air defenses, and extraction to the USS Iwo Jima—with Maduro and Flores transported to face U.S. charges. Reuters

Venezuela’s Response

Reuters reported Venezuela’s defense minister publicly said the country would resist the presence of foreign troops and described the early-morning events as an attack. Reuters

The Oil Factor Returns—Immediately

Time and other outlets reported Trump signaling that the U.S. would be “very strongly involved” in Venezuela’s oil industry after the operation, intensifying the global debate over sovereignty, legality, and long-term intentions. TIME+1

How the Month’s Escalation Fits Together

If you step back, the sequence looks less like random headlines and more like a pressure ladder:

- Physical enforcement begins (tanker seizure) Reuters

- Broader restriction posture is announced (blockade of sanctioned tankers) Reuters

- Export system clogs (floating storage, tank back-ups, near-paralysis) Reuters+1

- Kinetic phase (strikes + capture claim) Reuters+1

This is why many analysts frame January 3 as a climax of a month-long campaign centered on oil revenue denial + military readiness.

What’s Still Unclear (And What to Watch Next)

Even with extensive reporting, several questions remain open and will define the next phase:

- Who governs in Caracas now? AP reported major uncertainty about the political vacuum and what comes next. AP News

- What is the legal basis and international reaction? Coverage highlights immediate concerns about sovereignty and legality, and calls for investigation. The Guardian+1

- Will the oil system stabilize or fracture further? If exports remain constrained and storage remains saturated, PDVSA’s operational stability is at risk. Reuters+1

- Will the U.S. maintain a long-term role? Trump’s language about “running” Venezuela and oil involvement suggests prolonged engagement, though details are unsettled. TIME+1

Conclusion

Over the past month, Venezuela moved from an oil-shipping crackdown to an unprecedented U.S. military operation that Washington says ended with Maduro’s capture. The timeline shows a consistent escalation: interdiction → blockade posture → export paralysis → strikes and extraction.

Whatever happens next—negotiations, new leadership, further conflict, or an attempted transition—will likely be decided by two realities:

- control of security on the ground, and

- control of oil exports and revenues.

Those two levers have shaped the last month—and they will shape Venezuela’s future.

Is U.S. “Management” of Venezuela’s Oil a Modern Occupation? A Legal and Political Deep Dive

- Iran 2026 Explained: How Decades of Pressure Led to a Nationwide Shutdown

- European officials criticize the U.S. withdrawal from major climate frameworks.

- Venezuela Claims 100 Killed in U.S. Operation That Captured Maduro as Cuba Reports 32 Dead

- Demonstrators gather in Minneapolis following a fatal ICE-involved shooting.

- Venezuela’s Crisis Escalation: A One-Month Timeline From Oil Tanker Seizures to Maduro’s Capture